Here we are and it is October 11, 2008 – there are only 21 single family homes and 2 townhouses for sale here in our lovely Hollywood Riviera neighborhood. That is very low inventory, especially when you consider that this is the “last push” of the year (best time to sell before the holidays hit.)

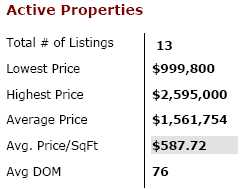

Of those 21 homes, 13 (including the two townhouses on lower Calle Miramar) are on the Redondo Beach side of the Hollywood Riviera – with an average sales price of $1,561,754. Lowest price being just under $1 million and highest over $2.5 million (for new construction.) As you can see the Redondo Beach side of the Hollywood Riviera is quite pricey right now.

The Torrance side of the Hollywood Riviera has 10 homes for sale and their average sales price is $1,015,000 with the most expensive asking a list price of $1,399,000 (it has some of the most gorgeous panoramic queen’s necklace views with no utility wires to distract) and the lowest priced home is currently $625,000 on the PCH service street.

Interesting however that the Redondo Beach side has a much greater Days on Market number – 76 vs 37 on the Torrance side. Part of the reason for this is that the Torrance side with its lower sales prices is moving homes into sold much quicker.

The pace of home sales here priced under $1 million is much brisker than the pace of homes sales here over $1.2 million. Jumbo Mortgages are much harder to attain and cost quite a bit more than their Conforming Mortgage friends. Currently, the Conforming Jumbo Mortgage, thanks to the Economic Stimulus Plan of 2008, is at $729,750. That makes it still pretty hard to buy a million dollar home w/ only 20% down…as you can see you would actually need closer to 30% down to make this work. Also, part of the problem….people need to come in with a lot of cash to buy the more expensive homes here. Starting January 1, 2009, the “Conforming Jumbo Mortgage” will go down to $625,000 – which in my opinion will not serve our area well. Hopefully, mortgage underwriting guidelines will loosen up a bit when that conforming jumbo number comes down to $625,000 – as it will really be much harder to obtain financing for the more expensive home at that point – and it will cost more. Currently, the difference in cost between a “conforming” loan and a “conventional” loan is about 2 to 2 1/2 points…this is a big difference in your monthly payments every month.