Wow….A $150 billion economic stimulus plan being negotiated by the Bush administration and congressional leaders could include a temporary boost in the $417,000 conforming loan limit on mortgages eligible for purchase or guarantee by Fannie Mae and Freddie Mac.

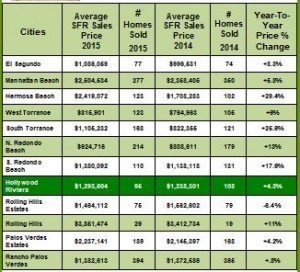

This dramatically effects our market here – by raising the conforming loan limit to $625,000 and possibly $730,000 in our California market would be exactly what home buyers would need to push them off the fence in this area. With the average home price here in the Hollywood Riviera currently above $1.1 million dollars, almost every buyer would need what is currently a “jumbo loan.” The current “conforming loan limit” is $417,000. The only buyers that use those kind of loans in our market are either people with a lot of cash to put down or someone buying a small condo or something in the $500K – $600K price range (which does not get you a lot of home here in the South Bay.) I, for one, could certainly see this being a huge boost for buyers and sellers here in our market!

The higher cap, to be effective until the end of December, would breathe life into housing markets in New York, California and other pricey areas because lenders would feel more comfortable knowing Fannie and Freddie can buy and package the loans into securities that investors consider to be relatively safe. NAR aka The National Association of Realtors maintains that raising the conforming loan limit to $625,000 would prevent 140,000 to 210,000 foreclosures, bolster home prices by 2 to 3 percentage points, and increase economic activity by $42 billion.

This is certainly something to stay tuned in for!