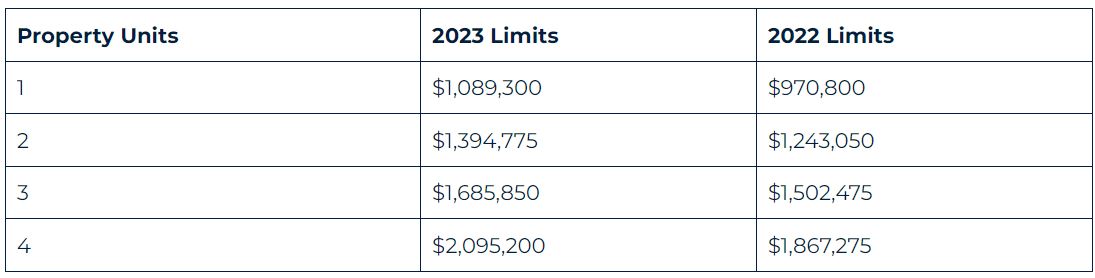

What is a Conforming Loan Limit? Both Fannie Mae and Freddie Mac set limits on home loans that they will buy or guarantee. The Federal Housing Finance Agency (FHFA) publishes annual conforming loan limits that apply to all conventional mortgages delivered to Fannie Mae and Freddie Mac.

The limits for conforming loans and FHA loans increased in 2023 to account for a rise in home prices. This gives homebuyers more flexibility in how they finance a home purchase. In spite of skyrocketing mortgage rates, average home prices are still increasing by double digits year over year. To help potential homebuyers caught between this crunch of high home prices and mortgage rates, two federal entities—the Federal Housing Finance Agency (FHFA) and the Federal Housing Administration (FHA) have raised conforming loan limits and FHA loan limits for 2023.

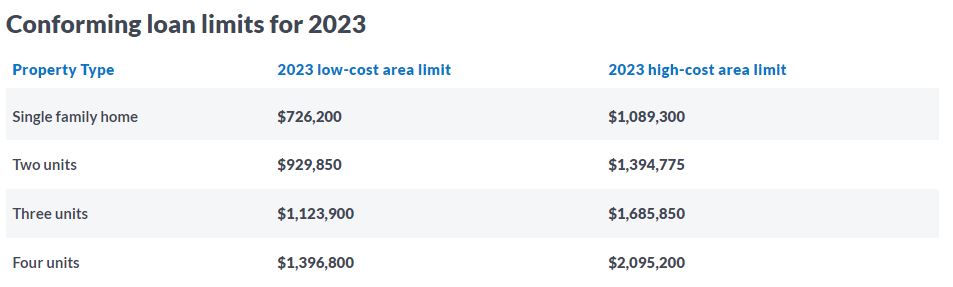

A note about these California conforming limits: These are conforming loan limits. You are able to purchase a property over these limits with a down payment. As an example, and if you qualify, if your goal is to put 5% down on a property and that property is located in San Bernardino County California, you could purchase a property up to $764,421 and have a loan of $726,200 and still be considered conforming. (This is an example of a lower priced county in California. Their conforming loan limits are lower than those in Los Angeles County, who has the highest conforming loan limits due to its high price of homes.

This is a significant increase: 11% year over year for single units or almost $120,000. This is a major bump up for buyers offering them more buying power in a market that has gone up at least this much in the last couple of years in our high cost Los Angeles county area. This single-unit increase will help buyers purchase more expensive condos, townhomes, and even specific single-family residences in 2023 especially here in our local beach cities, Redondo Beach, Hermosa Beach, Torrance, as well as the Palos Verdes Peninsula neighborhoods such as Lunada Bay, Valmonte, Rolling Hills Estates, & Malaga Cove.

What’s more, are the valuable increases to duplex, triplex, and fourplex purchases. For buyers it is especially significant when it comes to income properties. Thanks to conforming lenders giving credit to rents as added income, many buyers can purchase a much more expensive property than one unit since their income calculations can increase significantly. It is important to buyers to consider the advantages of buying/living in a unit of an income property because of the powerful wealth creating effects.

It is important to discuss how these limits will impact your ability to qualify for a mortgage with your local South Bay mortgage broker and your South Bay real estate agent. Happy House Hunting in 2023!